IPQS Launches Enterprise Fintech Solutions & Partnerships

IPQS launches its on-premise Email Verification Database, giving fintechs faster, secure fraud detection with full data control and compliance.

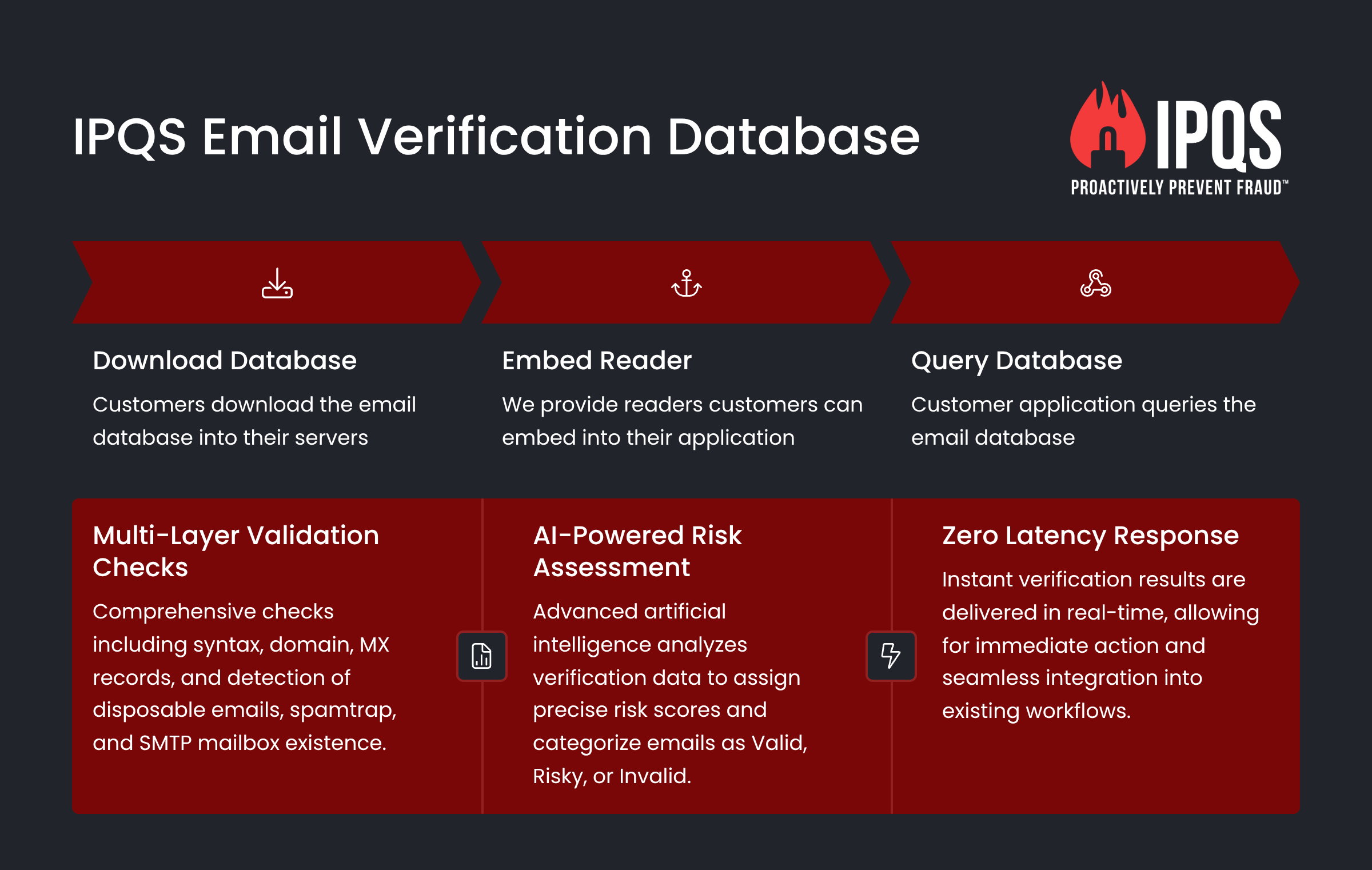

MIAMI, FL, UNITED STATES, October 8, 2025 /EINPresswire.com/ -- IPQS, the global leader in user validation and fraud prevention, today announced the introduction of its Email Verification Database, an enterprise-grade, on-premises email validation solution designed to provide fintech and financial services firms with accelerated, more secure fraud detection.

The new database supports locally authenticating email addresses without relying on external APIs, while maintaining the same velocity and dependability IPQS is renowned for. Companies can detect disposable accounts, spam traps, bots, and abusive domains in real time, preventing fraud from ever reaching your doors while adhering to strict data residency requirements.

This release supplements IPQS's existing IP Reputation Database. It broadens the coverage of IPQS's intelligence following its recent integration with Alloy, making Alloy's identity decisioning platform available to IPQS's intelligence.

"Companies need fraud prevention that is not just accurate but fast and regulatory compliant," said Dennis Weiss, CEO of IPQS. "Our Email Verification Database gives organizations complete control, sub-millisecond delay, and the ability to block fraud before it impacts revenue."

Benefits are:

- Enterprise performance for high-workload applications

- Local hosting for total data control and compliance

- Pre-built libraries for Python, Java, Golang, PHP, and Rust

IPQS's multi-layered solution, which includes device fingerprinting, dark web surveillance, phone and email intelligence, offers fintechs a complete fraud prevention ecosystem. The company also recently joined the FIDO Alliance, further tackling global standards for secure authentication and identity. In support of this initiative, IPQS is excited to attend the Authenticate Conference 2025, organized by the FIDO Alliance, October 13–15, where attendees can meet the IPQS team at K14 and explore their latest fraud prevention and authentication solutions

IPQS will be also showcasing its solutions at Money20/20 USA October 26-29 in Las Vegas, booth #20067.

Amber Kahr

IPQS

+1 800-713-2618

amber@ipqs.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.