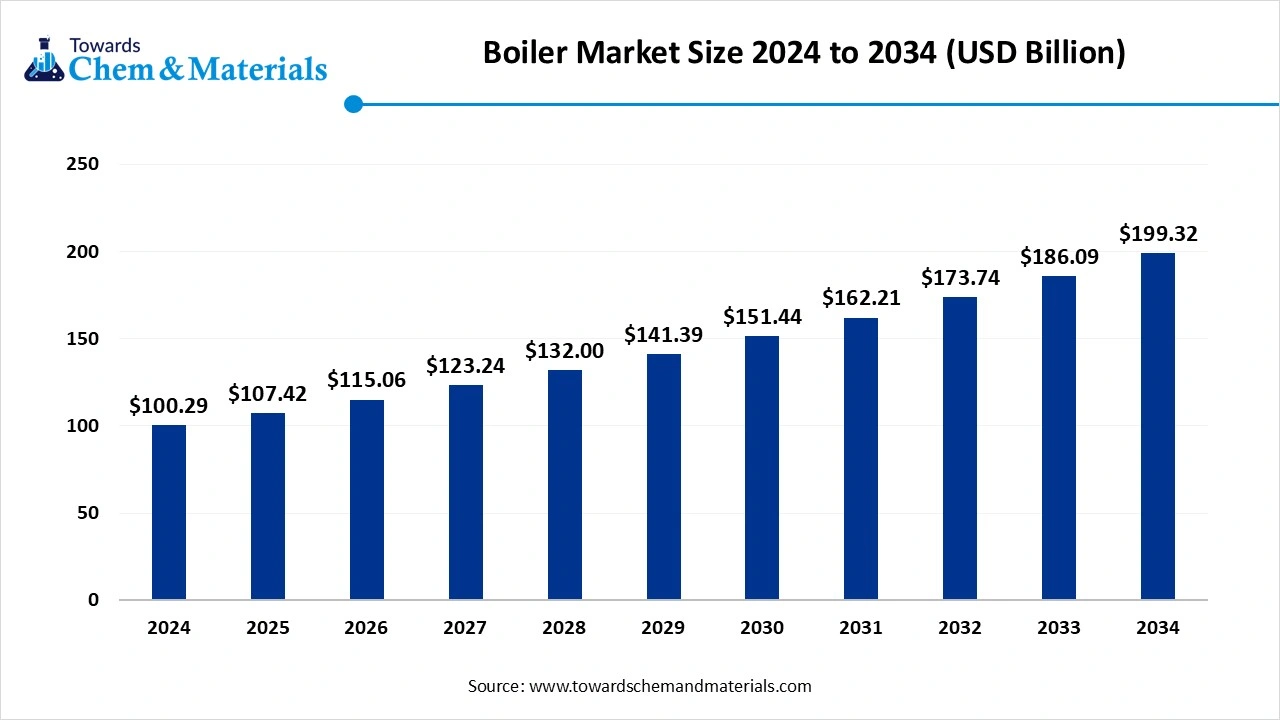

Boiler Market Size to Worth USD 199.32 Billion by 2034

According to Towards Chemical and Materials, the global boiler market size is calculated at USD 107.42 billion in 2025 and is expected to be worth around USD 199.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.11% over the forecast period 2025 to 2034.

Ottawa, Sept. 29, 2025 (GLOBE NEWSWIRE) -- The global boiler market size was valued at USD 100.29 billion in 2024 and is estimated to hit around USD 199.32 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.11% during the forecast period 2025 to 2034. A key growth factor for the market is the rising demand for energy efficient heating systems driven by stricter environmental regulations. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5717

Boiler Market Overview

The boiler market encompasses systems that produce steam or hot water industrial, commercial, and residential applications, operating across different pressure, fuel, and technology categories. The demand for these systems is being shaped by growing industrialization, rising energy consumption, and tighter regulations pushing for more efficient and lower emission heating solutions. Across regions, growth is being driven by infrastructure development and modernization of industrial facilities, particularly in Asia Pacific. In terms of fuel, there is a gradual shift toward cleaner sources as markets adopt gas, biomass, and hybrid options. On the technology front, considering and high efficiency systems are gaining traction as operators aim to reduce operational costs and carbon footprints. In end use, industries with high thermal demand such as chemicals, food processing, and power generation remain major consumers of boiler systems. Application wise, steam, generation continues to dominate given its versatility across many processes. As the market evolves, retrofit and upgrade projects, smarter control systems, and fuel flexibility are expected to become more prominent elements.

Boiler Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 115.06 Billion |

| Revenue forecast in 2034 | USD 199.32 Billion |

| Growth rate | CAGR of 7.11% from 2025 to 2034 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Type Insights, By Capacity , Fuel Type Insights, Pressure Type Insights, Technology Insights, By end Use Industry, Application Type Insights, By Region |

| Key companies profiled | General Electric (GE Power), Babcock & Wilcox Enterprises, Mitsubishi Heavy Industries, Bosch Thermotechnology ,Cleaver-Brooks , Thermax Ltd. , Hurst Boiler & Welding Co., Fulton Boiler Works, Inc., Viessmann Group , Miura Co., Ltd. , Lochinvar, LLC , Forbes Marshall , Johnston Boiler Company , Bryan Steam LLC , IHI Corporation Aalborg Industries (Alfa Laval) , Clayton Industries , Parker Boiler Co. , Unilux Advanced Manufacturing, Sime Heating (Biasi Group) |

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5717

What Are The Major Trends In The Boiler Market?

- Rising demand for energy efficient boilers, with many stakeholders shifting from traditional boilers to those that consumer less fuel and reduce emissions.

- Growing integration of smart features such as remote monitoring and automation to improve performance and reduce maintenance burden.

- Increasing focus on cleaner fuels and renewable alternatives such as biomass to address environmental concerns and regulatory pressures.

- Expansion driven by industrial application, specially in sectors like chemicals, food processing, and power generation where demand for process heating and steam is high.

- Rising adoption of condensing and high efficiency technologies as end users look to lower operational costs and comply with stricter emission norms.

How Does AI Influence The Growth Of The Boiler Market In 2025?

Artificial intelligence is influencing the growth of the boiler market in 2025 by transforming how these systems are monitored, operated, and maintained. AI powered predictive maintenance tools allow operators to detect potential faults before they lead to breakdowns, reducing downtime and extending equipment life. Intelligent optimization algorithms enable boilers to adjust fuel use, combustion levels, and load demand dynamically, resulting in higher energy efficiency and lower emissions. AI also supports real time remote monitoring and automation, helping industries manage multiple units simultaneously with greater precision. As industries and utilities face stricter emission regulations and rising energy costs. The integration of AI into boiler systems is becoming a practical solution for achieving sustainability goals while improving operational reliability. This technological shift is encouraging adoption across manufacturing, power generation, and process industries, thereby accelerating market growth.

Boiler Market Suppliers

| Supplier | 2024 EBITDA % | Basis / note | |

| Alfa Laval | 16.6 | % | Adjusted EBITA margin, full-year 2024 |

| SPX Technologies | ~21.2% | Adjusted EBITDA margin (calculated from revenue and adj. EBITDA) | |

| Thermax | 11.86 | % | EBITDA margin, FY ended Mar-2024 |

| Mitsubishi Heavy Industries (MHI) | 10.8 | % | EBITDA margin, FY2024 (ended Mar-2025) |

| Babcock & Wilcox (B&W) | ~9.6% | Adjusted EBITDA margin (calculated from revenue and adj. EBITDA) | |

| GE Vernova | 5.8 | % | Adjusted EBITDA margin, full-year 2024 |

Supplier explanations (with 2024 EBITDA %)

-

Alfa Laval — 16.6% (Adjusted EBITA margin, 2024)

A heat-transfer, separation and fluid-handling leader supplying boiler heat-exchangers, burners, and boiler modules for marine/energy markets. Margin strength reflects high-mix products and services and disciplined pricing. -

SPX Technologies — ~21.2% (Adj. EBITDA margin, 2024)

Industrial engineered products group; boiler exposure via Weil-McLain (heating) and related thermal equipment. The high 2024 adjusted EBITDA margin is derived from reported adj. EBITDA $421m on $1.98bn revenue. -

Thermax — 11.86% (EBITDA margin, FY Mar-2024)

Major India-based energy & environment solutions supplier (industrial boilers/heaters, WtE, utilities O&M). FY24 margin improvement versus prior years reflects execution and mix; company is a key boiler EPC/OEM in Asia. -

Mitsubishi Heavy Industries — 10.8% (EBITDA margin, FY2024)

Global heavy-engineering OEM with large power & energy systems (including steam generators/boilers via its Energy Systems). FY2024 saw record orders; EBITDA margin disclosed at 10.8%. -

Babcock & Wilcox — ~9.6% (Adj. EBITDA margin, 2024)

Focused on thermal/renewable/environmental technologies and boiler services. Reported Adjusted EBITDA $68.9m on $717.3m revenue ⇒ ~9.6% margin for 2024. -

GE Vernova — 5.8% (Adjusted EBITDA margin, 2024)

Energy equipment & services (Power/Wind/Electrification), including steam power and boiler service capabilities after GE’s restructuring. Reported 5.8% adjusted EBITDA margin for full-year 2024.

2024 Global Boiler Market Shares by Leading Manufacturers (in %)

| Rank | Manufacturer | 2024 Share (%) | Primary Focus | Key Regions | |

| 1 | Mitsubishi Power | 12 | % | Large utility & industrial boilers, ultra-supercritical/HELE units, retrofit/aftermarket | Japan, APAC, Middle East |

| 2 | Vaillant Group | 10 | % | Residential condensing gas/combi, heat-only & system boilers; service networks | Europe, UK |

| 3 | Doosan Enerbility | 9 | % | Utility & industrial boilers, turnkey EPC for thermal plants | Korea, Middle East, APAC |

| 4 | Bosch Thermotechnology | 9 | % | Residential & commercial hydronic/steam, packaged boilers | Europe, Global |

| 5 | BDR Thermea (Baxi, Remeha, De Dietrich) | 8 | % | Residential & light-commercial condensing boilers; multi-brand channels | Europe, UK |

| 6 | Ariston Group | 7 | % | Residential boilers & hot water; value & mid-premium mix | Europe, Latin America, APAC |

| 7 | Viessmann Climate Solutions | 7 | % | Premium residential/commercial boilers; integrated controls | DACH, Europe |

| 8 | Navien (KD Navien) | 6 | % | High-efficiency condensing boilers & water heaters | Korea, U.S., Europe |

| 9 | Bharat Heavy Electricals (BHEL) | 6 | % | Utility-scale and industrial boilers; domestic EPC | India |

| 10 | Harbin Boiler (Harbin Electric Group) | 6 | % | Large utility/industrial boilers, supercritical units | China, APAC |

| 11 | A. O. Smith / Lochinvar | 5 | % | Commercial/residential boilers & water-heating systems | North America, Europe |

| 12 | Cleaver-Brooks | 5 | % | Packaged firetube & watertube, rental & aftermarket | North America |

| 13 | Thermax | 5 | % | Industrial packaged boilers, waste-to-energy, services | India, MEA, SE Asia |

Notes & Rationale (by manufacturer)

-

Mitsubishi Power (12%)

- Strong backlog and installed base in utility-scale and large industrial boilers.

- Mix boosted by high-efficiency, low-emissions (HELE) retrofits and long-cycle aftermarket.

-

Vaillant Group (10%)

- Top-tier presence in residential condensing gas/combi across Western Europe.

- Dense service network and brand strength support stable replacement demand.

-

Doosan Enerbility (9%)

- Turnkey EPC capability keeps it prominent in thermal utility and industrial projects.

- Healthy exposure to Middle East/APAC project awards and service revenues.

-

Bosch Thermotechnology (9%)

- Balanced portfolio: residential, commercial, and industrial packaged boilers.

- Broad geographic footprint with strong European replacement cycles.

-

BDR Thermea (8%)

- Multi-brand strategy (Baxi, Remeha, De Dietrich) drives share in residential and light-commercial.

- Strong installer ecosystems and channel depth across the EU/UK.

-

Ariston Group (7%)

- Scale in value to mid-premium residential boilers, often bundled with water-heating.

- Expanding in Southern/Eastern Europe & emerging markets.

-

Viessmann Climate Solutions (7%)

- Premium positioning in residential & commercial boilers with advanced controls.

- Robust replacement demand in DACH and Northern Europe.

-

Navien (6%)

- Leadership in condensing technology; strong growth in U.S. and Korea.

- Crossover benefits from tankless water-heating footprint.

-

BHEL (6%)

- Dominant in India’s utility/industrial boilers; government & IPP pipeline support.

- Aftermarket and modernization underpin revenues.

-

Harbin Boiler (6%)

- Scale and localization in China for supercritical/ultra-supercritical units.

- Replacement/retrofit and industrial diversification sustain share.

-

A. O. Smith / Lochinvar (5%)

- Notable in commercial hydronic and high-efficiency segments in North America.

- Strong distribution and service networks.

-

Cleaver-Brooks (5%)

- Benchmark in packaged firetube/watertube, rentals, and services.

- Broad aftermarket keeps utilization high across institutional/industrial users.

-

Thermax (5%)

- Competitive in industrial packaged and waste-to-energy boilers in India/SEA.

- Service contracts and energy performance solutions add stickiness.

-

Babcock & Wilcox (5%)

- Mix of industrial & utility, with waste-to-energy/biomass expertise.

- Diversified aftermarket and modernization projects in NA/EU.

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Boiler Market Growth Factors

Why Is Shift Toward High Efficiency Boilers Accelerating?

The growing emphasis on energy efficiency is significantly influencing the boiler market in 2025. Industries and commercial establishments are increasingly adopting high efficiency boilers, such condensing and heat recovery units, to reduce energy consumption and operational costs. These advanced systems can achieve fuel efficiencies well above 90%, making them highly attractive for sectors like manufacturing and power generation. The adoption pressures, driving the demand for more efficient heating solutions.

How Are Government Incentives Shaping Boiler Market Dynamics?

Government policies and incentives are playing a pivotal role in the growth of the market. In regions like the UK, initiatives such as Boiler Upgrades Scheme offer grants for installing low-carbon heating systems, including biomass boilers. These financial incentives encourage homeowners and businesses to transition to more sustainable heating solutions, thereby expanding the market for eco-friendly boilers. Such policies not only promote energy efficiency bit also contribute to achieving national decarbonisation targets.

Market Opportunity

Can AI Optimized Boilers Enhance Energy Efficiency?

Artificial Intelligence (AI) is revolutionizing by integrating predictive analytics and real time monitoring. AI driven systems can anticipate maintenance needs, optimizing performance and reducing downtime. Additionally, AI algorithms adjust combustion processes to maximize fuel efficiency, leading a significant energy savings. This technological advancement not only lowers operational costs but also aligns with global sustainability goals by minimizing emissions. As industries seek smarter, more efficient solutions, AI enhanced boilers present a compelling opportunity for growth.

How Do Government Policies Influence Boiler Market Dynamics?

Government regulations play a crucial role in shaping the market by setting standards that encourage the adoption of cleaner technologies. Policies promoting energy efficiency and carbon reduction are driving demand for advanced boiler systems that meet stringent environmental criteria. Incentives such as grants and tax rebates further stimulate investment in these technologies. As governments worldwide intensify their focus on sustainability, businesses are compelled to upgrade their heating systems, creating a fertile ground for the expansion. These policies driven shifts are steering the industry towards greener, more efficient solutions.

Limitations In The Boiler Market

- The high upfront cost of advanced boilers acts as a barrier, specially for smaller businesses and mid-sized plants, delaying upgrades to cleaner or more efficient systems.

- Many regions face challenges from retrofitting or replacing older boiler systems, since doing of often requires major infrastructure changes and technical adaptation.

Boiler Market Segmentation Insights

Type Insights

Why Did The Fire Tube Boiler Segment Dominated The Boiler Market In 2024?

The fire tube boiler segment registered its dominance over the market in 2024. This type of boiler has been widely adopted due to its simple design, ease of operation, and reliability, making it suitable for various industrial and commercial applications. Its efficiency in handling moderate steam and pressure demands has made it a preferred choice among industries that require steady and dependable heating solutions. The widespread use of fire tube boilers in sectors like food processing, textiles, and chemical manufacturing reflects the strong confidence pf businesses in its performance. Additionally, the availability of maintenance expertise and the lower operational complexity contribute to its sustained popularity in the market.

The water tube boiler segment is expected to grow at the fastest rate during the forecast period. These boilers are gaining attention because of their capability to operate at higher pressures and temperatures, which makes the, suitable for large scale industrial operations. Industries such as power generation, petrochemicals, and heavy manufacturing are increasingly adopting water tube boilers to meet demanding production requirements while improving energy efficiency. Technological improvements, coupled with a focus on reducing emissions and operational costs, are further driving the rapid adoption of these boilers.

Capacity Type Insights

Why Did The 10-50 MMBTU/HR Capacity Type Segment Dominated The Boiler Market In 2024?

The 10-50 MMBTU/HR capacity type segment dominated the market in 2024. This mid-capacity range has been preferred by many small to medium sized industrial facilities because it effectively balances energy output with operational efficiency. Businesses operating in sectors such as food production, textiles, and small power plants often choose this capacity type to manage moderate energy requirements without investing in overly large systems. The accessibility of parts, ease of installation, and compatibility with existing infrastructure make it a practical choice for companies looking to maintain consistent steam and hot water supply.

The >100 MMBTU/HR capacity segment is expected to expand rapidly in the coming years. These high capacity boilers are increasingly demanded by large industrial operations that require massive amounts of steam and heat for continuous production processes. Facilities in power generation, oil refining, and chemical processing are investing in these boilers to ensure operational efficiency and meet stringent industrial standards. The adoption is further fuelled by technological innovations that allow these systems to operate more efficiently and reduce fuel consumption. With growing industrialization and energy demands, the >100 MMBTU/HR capacity segment is projected to see substantial growth across multiple regions.

Fuel Type Insights

Why Did The Natural Gas-Fired Segment Dominated The Boiler Market In 2024?

The natural gas-fired segment maintained a leading position in 2024. Natural gas boilers are preferred for their clean combustion, cost-effectiveness, and ability to provide stable and consistent heat. Many industrial and commercial facilities favour natural gas due to its availability, ease of storage, and lower emissions compared to coal or oil-fired alternatives. The shift toward environmentally friendly energy solutions has further strengthened the adoption of natural gas boilers, as companies aim to comply with emission regulations. Overall, the natural gas fired segment offers a combination of reliability, efficiency, and sustainability that makes it dominant in the market.

The biomass fired segment is projected to experience the highest growth rate between 2025 and 2034. The increasing interest in renewable and sustainable energy sources has positioned biomass as an attractive alternative to traditional fossil fuels. Industries are investing in biomass boilers to reduce carbon footprints, comply with environmental regulations, and take advantage of locally available resources. These systems are particularly popular in regions with strong agricultural output, allowing companies to utilize waste products efficiently. The push for greener operations and sustainable energy solutions ensures that biomass-fired boilers are among the fastest growing segment in the market.

Pressure Type Insights

Why Did The Low Pressure (<15 Psi) Segment Dominated The Boiler Market In 2024?

The low pressure (<15 psi) segment captured a largest portion of the market in 2024. Low pressure boilers are widely preferred for applications that do not require extremely high steam pressures, such as residential heating, small commercial facilities, and light industrial operations. Their simple design, safety, and ease of operation make them suitable for facilities with moderate heating demands. Companies value the reliability and low maintenance requirements of these systems, which helps reduce operational costs. Additionally, the widespread availability of services and support for low pressure boilers contributes to their dominant position in the market.

The high pressure (>150 psi) segment is set to experience the fastest rate of growth in the coming years. High pressure boilers are critical for industries such as power generation, chemical processing, and oil refining, where large volumes of steam and high temperature heat are essential. The increasing industrial demand for continuous, high efficiency processes is driving adoption of these boilers. Technological improvements have made high pressure systems safer and more energy efficient, encouraging more facilities to upgrade. As industrialization accelerates in emerging markets, the demand for high pressure boilers is expected to rise significantly.

Technology Insights

Why Did The Non-Condensing Segment Dominated The Boiler Market In 2024?

The non-condensing segment dominated the market in 2024. Non-considering boilers are popular due to their simplicity, proven performance, and ability to operate reliability in a wide range of industrial and commercial environments. They are easy to install and maintain, making them ideal for businesses that prioritize operational consistency over extreme efficiency. Many industries continue to use non-condensing systems for applications where energy recovery is not the permanent concern. The widespread familiarity with these systems among engineers and techniques reinforce their dominant position.

The condensing segment is anticipated to grow with the highest rate during the forecast period. Condensing boilers are designed to recover heat from exhaust gases, significantly improving energy efficiency and reducing fuel consumption. Industries and commercial facilities are increasingly adopting these systems to minimize operational costs and meet stricter environmental regulations. The rising focus on sustainability and reducing carbon emissions had made condensing technology a highly attractive options. As companies modernize their heating infrastructure, the demand for condensing boiler continues to accelerate.

End Use Insights

Why Did The Residential Segment Dominated The Boiler Market In 2024?

The residential segment captured the largest share of the market in 2024. Residential boilers are essential for providing reliable heat of modern boilers in households. The combination of high demand, operational simplicity, and broad availability of service supporting and hot water in homes and small residential complexes. Their accessibility, ease of use, and relatively lower installation complexity make them a common choice for homeowners. Additionally, government programs promoting energy efficient residential heating have reinforced the adoption of modern boilers in households. The combination of high demand, operational simplicity, and broad availability of service support maintains the dominance of residential boiler in the market.

The industrial segment is expected to grow with the fastest rate in the coming years. Industrial facilities require large scale, high performance boilers to support continuous production processes across sectors such as chemicals, food processing, and power generation. The growing emphasis on energy efficiency and operational cost reduction is encouraging industries to upgrade to advanced boiler systems. Technological innovations and automation further enhance the appeal of industrial boilers. With rapid industrialization in emerging economies, the industrial end-use segment is set to experience robust growth.

Application Insights

Why Did The Steam Generation Segment Dominated The Boiler Market In 2024?

The steam generation segment dominated the market in 2024. Steam generation is a critical application across various industries, including food processing, textiles, chemicals, and power plants. Its versatility and essential role in industrial processes make it the most adopted application type. Companies continue to rely on steam generation systems for consistent performance, energy, efficiency, and operational reliability. The strong market demand and proven benefits of steam generation solidifying its dominant position in the market.

The process heating segment is anticipated to grow with the highest rate in the coming years. Process heating is vital in industries such as chemicals, pharmaceuticals, and metal processing, where precise temperature control is required for production efficiency. The increasing need for energy-efficient and reliable heating solutions is driving adoption of advanced boiler technologies in this segment. Technological advancements and stricter environmental regulations further encourage the shift to modern, high performance systems. As industrial operations expand and modernize, process heating applications are expected to be the fastest growing area in the market.

Is Asia Pacific Leading the Global Boiler Market?

Asia Pacific dominated the market in 2024, driven by rapid industrialization and urbanization. Countries like China, India, and Japan have seen significant growth in sectors such as food processing, textiles, and chemicals, all of which rely heavily on efficient heating systems. The region’s expanding industrial base necessitates advanced boiler technologies to meet increasing energy demands. Additionally, governments in these countries are implementing policies to enhance energy efficiency and reduce carbon emissions, further propelling the demand for modern boiler systems. This combination of industrial growth and supportive policies solidifies Asia Pacific’s position as a leader in the global boiler market.

China plays a pivotal role in the Asia Pacific boiler market. The country’s vast industrial sector, encompassing power generation, manufacturing, and chemical industries, has a substantial demand for reliable and efficient boiler systems. China’s government is actively promoting energy efficiency programs and replacing outdates boiler systems to modernize its industrial infrastructure and meet stringent environmental standards. As a result, china continues to be a dominant force in shaping the boiler market landscape.

Is The Middle East And Africa Boiler Market Expanding Rapidly?

The Middle East Africa (MEA) is experiencing significant growth in the market. This expansion is driven by increasing industrialization, rising energy demands, and a focus on energy efficiency. Countries in the MEA region are investing in modernizing their infrastructure and adopting advanced boiler technologies to meet these growing needs. Additionally, government initiatives aimed at promoting sustainable energy practices are further fuelling the demand for efficient and environmentally friendly boiler systems. As a result, the MEA boiler market is poised for continued growth in the coming years.

Saudi Arabia and South Africa are poised to become key players in the market within the region, driven by substantial in oil refining and power generation, which have fuelled demand for high performance boilers. In south Africa, in the mining sector has emerged as a significant customer base for boiler manufacturers. Meanwhile, Saudi Arabia’s rapid industrialization has significantly supported the growth of the boiler industry in recent years, highlighting the strong market potential in both countries.

More Insights in Towards Chemical and Materials:

Boiler Water Treatment Chemicals Market : The global boiler water treatment chemicals market size was reached at USD 5.52 billion in 2024 and is expected to be worth around USD 15.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.85% over the forecast period 2025 to 2034.

Water & Wastewater Treatment Market : The water & wastewater treatment market size is calculated at USD 348.19 billion in 2024, grew to USD 371.00 billion in 2025, and is projected to reach around USD 656.68 billion by 2034. The market is expanding at a CAGR of 6.55% between 2025 and 2034.

Water Treatment Polymers Market : The global water treatment polymers market volume was valued at 8,323.10 kilotons in 2024 and is estimated to reach around 15,477.50 kilotons by 2034, exhibiting a compound annual growth rate (CAGR) of 6.40% during the forecast period 2025 to 2034.

Aquaculture Market : The aquaculture market size is calculated at USD 310.66 billion in 2024, grew to USD 326.66 billion in 2025, and is projected to reach around USD 513.31 billion by 2034. The market is expanding at a CAGR of 5.15% between 2025 and 2034.

Biopolymers Market : The global biopolymers market size was valued at USD 19.85 billion in 2024, grew to USD 21.93 billion in 2025, and is expected to hit around USD 53.68 billion by 2034, growing at a compound annual growth rate (CAGR) of 10.46% over the forecast period from 2025 to 2034.

Liquid Crystal Polymers Market : The global liquid crystal polymers market size was valued at USD 1.99 billion in 2024, grew to USD 2.25 billion in 2025, and is expected to hit around USD 6.73 billion by 2034, growing at a compound annual growth rate (CAGR) of 12.95% over the forecast period from 2025 to 2034.

Plastic Hot and Cold Pipe Market : The global plastic hot and cold pipe-market size was valued at USD 7.85 billion in 2024, grew to USD 8.37 billion in 2025, and is expected to hit around USD 14.93 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.64% over the forecast period from 2025 to 2034.

Building & Construction Materials Market : The global building and construction materials market size was valued at USD 2.19 trillion in 2024, grew to USD 2.32 trillion in 2025, and is expected to hit around USD 3.90 trillion by 2034, growing at a compound annual growth rate (CAGR) of 5.95% over the forecast period from 2025 to 2034.

Green Steel Market : The global green steel-market size was valued at USD 718.55 billion in 2024, grew to USD 763.10 billion in 2025, and is expected to hit around USD 1,311.30 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.20% over the forecast period from 2025 to 2034.

Commodity Plastics Market : The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

Commodity Chemicals Market : The global commodity chemicals market size was valued at USD 813.85 billion in 2024, grew to USD 867.97 billion in 2025, and is expected to hit around USD 1,549.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.65% over the forecast period from 2025 to 2034.

Building Materials Market : The global building materials market size was approximately USD 1.45 trillion in 2024 and is projected to reach around USD 2.17 trillion by 2034, with an estimated compound annual growth rate (CAGR) of about 4.11% between 2025 and 2034.

Boiler Market Top Key Companies:

- General Electric (GE Power)

- Babcock & Wilcox Enterprises

- Mitsubishi Heavy Industries

- Bosch Thermotechnology

- Cleaver-Brooks

- Thermax Ltd.

- Hurst Boiler & Welding Co.

- Fulton Boiler Works, Inc.

- Viessmann Group

- Miura Co., Ltd.

- Lochinvar, LLC

- Forbes Marshall

- Johnston Boiler Company

- Bryan Steam LLC

- IHI Corporation

- Aalborg Industries (Alfa Laval)

- Clayton Industries

- Parker Boiler Co.

- Unilux Advanced Manufacturing

- Sime Heating (Biasi Group)

Recent Developments

- In September 2025, The Gujrat government announced it has completed inspection of all boiler in the state, ensuring compliance and industrial safety after years of boiler related incidents. This initiative underscored growing regulatory scrutiny and emphasis in industrial regions.

- In September 2024, Babcock Wanson launched the LV-Pack. The product introduction is a notion by this company to avail low-voltage industrial electric boilers which are aimed at enhancing energy efficiency. There are apparent investments made by Babcock into sustainable development technologies and the deployment of this new product further marks the company’s enhancement in its offerings. The LV-Pack’s purpose is to help the industrial sector achieve the required clean and reliable energy systems through enhanced operational efficiency and reduced carbon emissions, lowering operational costs.

- In January 2024, Carrier has officially purchased Viessmann Climate Solutions which is a sub company of Viessmann Group. This business acquisition is a step forward into the strategic portfolio advancement and transformation within Carrier’s operations wherein it seeks to take on a competitive edge internationally especially within the realm of intelligent climate and energy solutions. The clear conscience of the organization is to strive in assisting the metamorphosing market requirements through incorporation of enhanced services and products.

Boiler Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Boiler Market

By Type

- Fire-tube Boiler

- Water-tube Boiler

- Electric Boiler

- Combi Boiler

- Condensing Boiler

- Modular Boiler

By Capacity

- <10 MMBtu/hr

- 10–50 MMBtu/hr

- 50–100 MMBtu/hr

- >100 MMBtu/hr

By Fuel Type

- Natural Gas-fired Boilers

- Coal-fired Boilers

- Oil-fired Boilers

- Biomass-fired Boilers

- Electric Boilers

- Hydrogen-fired Boilers

By Pressure

- Low Pressure (<15 psi)

- Medium Pressure (15–150 psi)

- High Pressure

By Technology

- Condensing Boiler

- Non-condensing Boiler

By End-Use Industry

- Residential

- Commercial

- Educational Institutions

- Healthcare

- Offices

- Hospitality

- Industrial (Fastest growing; driven by chemicals, food, etc.)

- Food & Beverage

- Chemicals

- Oil & Gas

- Pulp & Paper

- Power Generation

- Metals & Mining

- Textiles

By Application

- Steam Generation (Largest; ~50% share)

- Hot Water Generation

- Process Heating (Fastest growing, especially in industrial segments)

- Space Heating

- Sterilization

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5717

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.